Sin categoría

¿Qué son las impresoras industriales para productos?

Impresoras industriales para productos en Perú. La impresión industrial ha emergido como una tecnología crucial para mejorar la eficiencia, personalización y calidad de los productos. En Perú, la adopción de impresoras industriales o codificadoras industriales ha ido en constante crecimiento, impulsando la innovación en diversas industrias. En este artículo, exploraremos ¿Qué son las impresoras industriales para productos en Perú?, sus

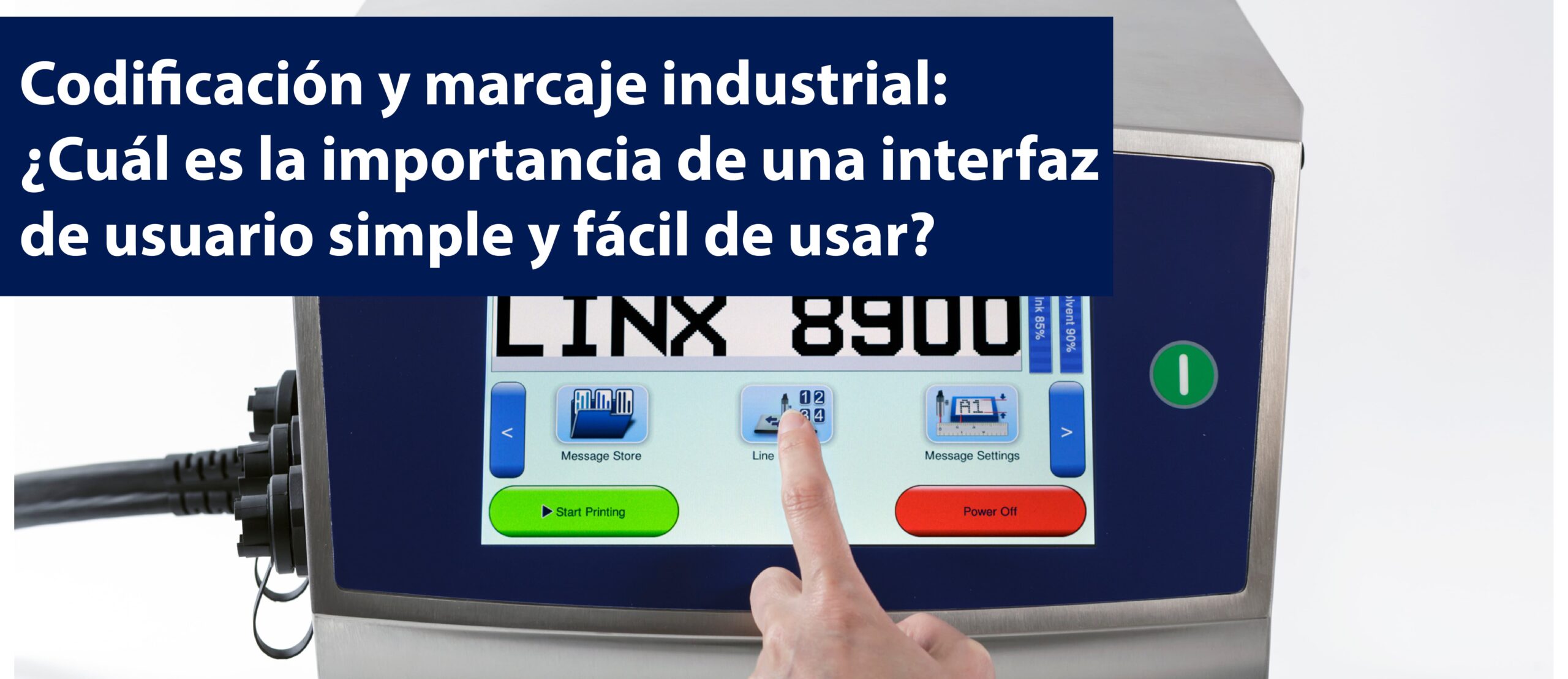

Codificación y marcaje industrial: ¿Cuál es la importancia de una interfaz de usuario simple y fácil de usar?

Reducción del tiempo de inactividad: La importancia de una interfaz de usuario simple y fácil de manejar. Ya sea que se dirija a una empresa multinacional o una pequeña, la codificación y marcaje industrial es fundamental tanto para generar compromiso con el cliente como para cumplir con el deber de proteger la salud del consumidor. Con los avances se ha

Loteadoras y fechadoras para cárnicos, ¿oportunidad u obstáculo?

Los alimentos cárnicos desempeñan un papel esencial en la alimentación del consumidor peruano, esto porque son una fuente principal de proteínas de alto valor biológico fácilmente asimilables por nuestro organismo. Debido a su gran consumo existen normativas que permiten controlar y garantizar una trazabilidad que de seguridad a los consumidores. La libre circulación de alimentos seguros y saludables es un

Máxima productividad y eficiencia con los codificadores industriales para envases plásticos

El etiquetado de productos o la codificación de productos, son extremadamente importantes a lo largo del ciclo de producción, para el cumplimiento de requisitos legales y la información al usuario final. Con la necesidad de una trazabilidad cada vez más completa, la necesidad de contar con codificadores industriales para envases plásticos es fundamental para adaptarse a la legislación, controles internos

Equipos codificadores para mejorar los productos de exportación de salsas y aderezos

Los condimentos o salsas y aderezos están presentes en muchas de las comidas que consumimos. En el caso del Perú se exportan variedad de estos productos, estos podrían ser los casos de las salsas de huacatay, rocoto, huancaína, la salsa anticuchera o jaleas de grutos exóticos como camu camu y aguaymanto. Además de las salsas, el Perú cuenta con gran